Wallet Blend Analytics Guide for Dune

Introduction

This guide helps wallet builders track their users' activity on Blend Protocol. It builds upon the General Wallet Analytics Guide and focuses specifically on DeFi metrics.

This tracking considers direct interaction with Blend without any intermediary contract such DeFindex or Blend Vaults. For Defindex, check the DeFindex Dashboard Guide for a sample dashboard.

Overview

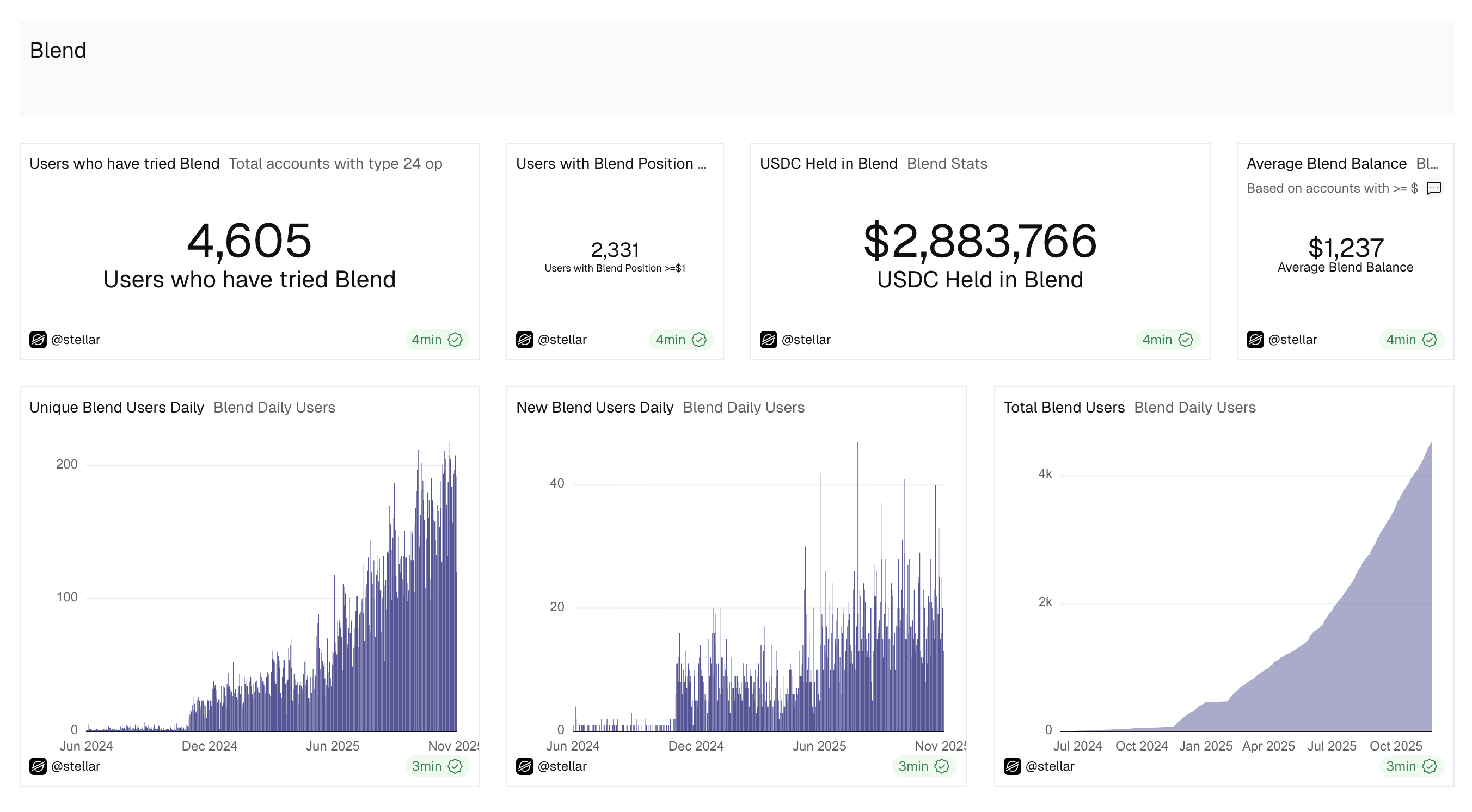

This guide covers Blend-specific metrics:

- Blend pool identification

- User positions (collateral, liabilities, supply)

- Daily active Blend users

- USDC in Blend across your wallet's users

- New vs. returning Blend users

Step 1: Identify Blend Pools (Materialized Query)

This query identifies all Blend lending pools and their assets. This is not wallet-specific and can be shared across all wallets.

You can use the public materialized view dune.stellar.result_blend_pools to get the list of Blend pools and their assets.

Step 2: Get Current Blend Positions (Materialized Query)

This query extracts the latest Blend positions for all accounts across all pools. This is also shared across wallets.

You can use the public materialized view dune.stellar.result_blend_positions to get the latest Blend positions for all accounts across all pools.

Step 3: USDC in Blend for Your Wallet

Now we can filter the shared Blend positions to only your wallet's users. This example is using USDC as the asset, but you can replace it with any asset by updating the asset_code and asset_issuer.

-- Query: Wallet USDC in Blend

-- Total USDC across all Blend positions for your wallet's accounts

WITH wallet_usdc_positions AS (

SELECT

bp.address,

SUM(COALESCE(bp.collateral, 0)) AS total_collateral,

SUM(COALESCE(bp.liabilities, 0)) AS total_liabilities,

SUM(COALESCE(bp.supply, 0)) AS total_supply,

SUM(COALESCE(bp.collateral, 0) - COALESCE(bp.liabilities, 0)) AS net_position

FROM dune.stellar.result_blend_positions AS bp

INNER JOIN dune.[your_team_name].result_[your_wallet_name]_accounts AS wallet

ON bp.address = wallet.account_id

WHERE bp.asset_code = 'USDC'

AND bp.asset_issuer = 'GA5ZSEJYB37JRC5AVCIA5MOP4RHTM335X2KGX3IHOJAPP5RE34K4KZVN'

GROUP BY bp.address

)

SELECT

SUM(total_collateral) AS total_usdc_collateral,

SUM(total_liabilities) AS total_usdc_liabilities,

SUM(total_supply) AS total_usdc_supply,

SUM(net_position) AS net_usdc_position,

COUNT(DISTINCT address) AS wallet_accounts_with_usdc_positions,

COUNT(DISTINCT CASE WHEN net_position >= 1 THEN address END) AS accounts_with_usdc_gte_1,

SUM(CASE WHEN net_position >= 1 THEN net_position END) /

NULLIF(COUNT(DISTINCT CASE WHEN net_position >= 1 THEN address END), 0) AS avg_usdc_held_blend_gte_1

FROM wallet_usdc_positions

Metrics Explained:

total_usdc_collateral: USDC deposited as collateral across all userstotal_usdc_liabilities: USDC borrowed across all userstotal_usdc_supply: USDC supplied to the pool (earning interest)net_usdc_position: Net USDC position (collateral - liabilities)accounts_with_usdc_gte_1: Users with at least 1 USDC net in Blendavg_usdc_held_blend_gte_1: Average USDC per user (excluding dust positions)

Setup: Create single value visualizations for each metric.

Step 4: Daily Active Blend Users

Track daily unique Blend users and identify first-time users:

-- Query: Daily Blend Users

-- Daily unique Blend users for your wallet (any Blend contract interaction)

-- Tracks all Blend interactions: positions, liquidations, rewards, etc.

-- Also identifies first-time Blend users

WITH wallet_blend_activity AS (

SELECT

DATE(closed_at) AS day,

CAST(JSON_EXTRACT(key_decoded, '$.vec[1].address') AS VARCHAR) AS user_address,

MIN(DATE(closed_at)) OVER (PARTITION BY CAST(JSON_EXTRACT(key_decoded, '$.vec[1].address') AS VARCHAR)) AS first_interaction_day

FROM stellar.contract_data

WHERE deleted = FALSE

AND contract_id IN (

SELECT DISTINCT pool_contract_id

FROM dune.stellar.result_blend_pools

)

-- Extract address from various key patterns (vec[1].address is common pattern)

AND JSON_EXTRACT(key_decoded, '$.vec[1].address') IS NOT NULL

AND CAST(JSON_EXTRACT(key_decoded, '$.vec[1].address') AS VARCHAR) IN (

SELECT account_id

FROM dune.[your_team_name].result_[your_wallet_name]_accounts

)

)

SELECT

day,

COUNT(DISTINCT user_address) AS unique_wallet_users,

COUNT(*) AS position_updates,

COUNT(DISTINCT CASE WHEN day = first_interaction_day THEN user_address END) AS new_blend_users,

SUM(COUNT(DISTINCT CASE WHEN day = first_interaction_day THEN user_address END))

OVER (ORDER BY day) AS cumulative_blend_users

FROM wallet_blend_activity

GROUP BY day

ORDER BY day DESC

Metrics:

unique_wallet_users: Daily active Blend users from your walletposition_updates: Number of position changes (deposits, withdrawals, borrows, repayments)new_blend_users: First-time Blend users on that daycumulative_blend_users: Running total of unique Blend users

Setup: Create a line chart with day on X-axis and unique users on Y-axis. Add a secondary axis for cumulative users.

Step 5: All Assets in Blend

To track all assets (not just USDC), modify Step 3:

-- Query: All Assets in Blend for Your Wallet

WITH wallet_all_positions AS (

SELECT

bp.asset_code,

bp.asset_issuer,

bp.address,

SUM(COALESCE(bp.collateral, 0)) AS total_collateral,

SUM(COALESCE(bp.liabilities, 0)) AS total_liabilities,

SUM(COALESCE(bp.supply, 0)) AS total_supply

FROM dune.stellar.result_blend_positions AS bp

INNER JOIN dune.[your_team_name].result_[your_wallet_name]_accounts AS wallet

ON bp.address = wallet.account_id

GROUP BY bp.asset_code, bp.asset_issuer, bp.address

)

SELECT

asset_code,

asset_issuer,

SUM(total_collateral) AS total_collateral,

SUM(total_liabilities) AS total_liabilities,

SUM(total_supply) AS total_supply,

SUM(total_collateral - total_liabilities) AS net_position,

COUNT(DISTINCT address) AS unique_users

FROM wallet_all_positions

GROUP BY asset_code, asset_issuer

ORDER BY net_position DESC

Setup: Create a table visualization showing each asset and its totals.

Understanding Blend Metrics

Collateral vs Supply

- Collateral: Assets deposited that can be borrowed against. These assets are "locked" as collateral for loans.

- Supply: Assets supplied to the pool earning interest but not used as collateral for borrowing.

- Liabilities: The amount borrowed by the user.